STEP ONE: If you have damage, contact your insurance company immediately.

After you call, your insurance company should send an adjuster to document and assess the damage. That could take a day or two (or more), depending on the company and the level of damage.

If your home got flooded — and you have flood insurance — reach out to the National Flood Insurance Program or your private flood insurer. More on that below. Download this handbook that includes everything you need to know about your federal flood policy coverage.

For all other damage around your home, damage not caused by water contact your homeowners insurance company.

Here’s a complete list of Florida homeowners and automobile insurance companies and their contact information.

For the National Flood Insurance Program, call 877-336-2627.

Who covers what?

A typical homeowners insurance policy does not cover flood damage, and carriers will refuse to cover any damage they believe was caused by flooding/surge.

Most flood policies are through the federal National Flood Insurance Program, which is overseen by the Federal Emergency Management Agency (FEMA).

It may be that your home sustained both types of damage, such as a tree falling through the roof or several inches of flooding. In those cases, contact both of your insurers.

Document your damage:

Your insurance company will want a lot of photos. take photos and videos of the affected areas and of any items that were damaged. Make a list of those items. Record serial numbers, and hang on to receipts if you have them.

The National Flood Insurance Program has a page with instructions on how to document damage.

Dealing with the National Flood Insurance Program

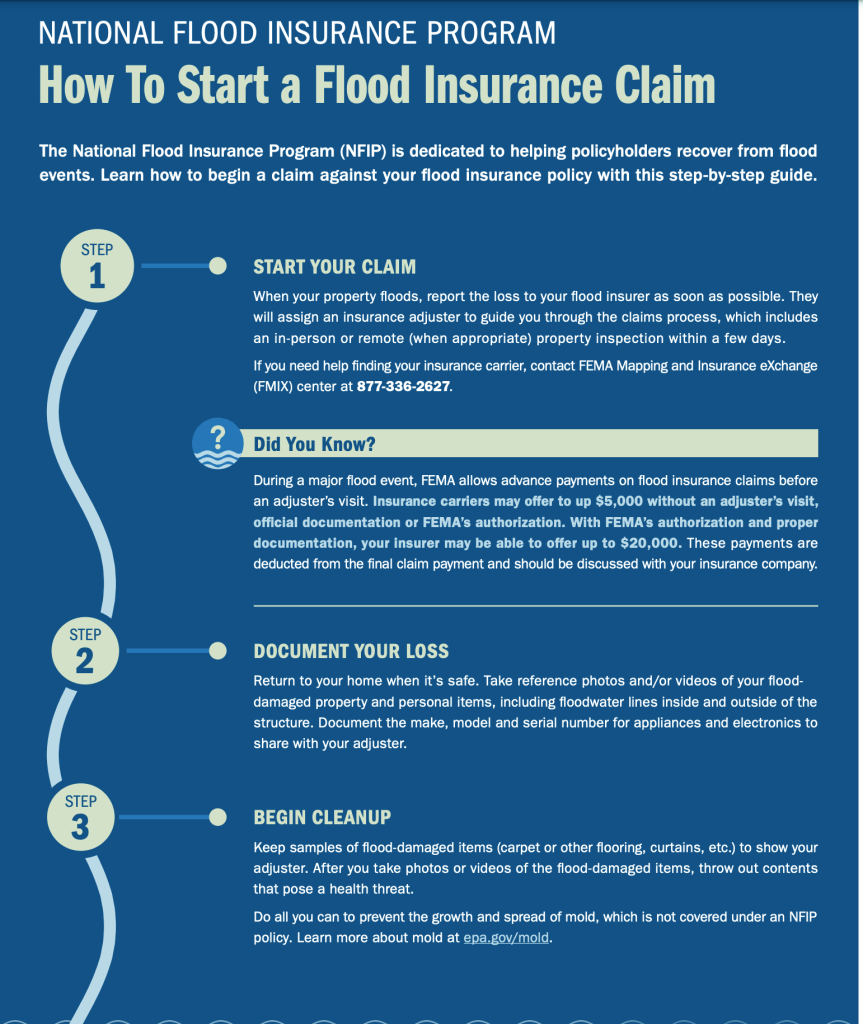

Whether your home experienced a few inches of flood water or a few feet, the National Flood Insurance Program (NFIP) can help you recover. If you’re an NFIP policyholder, follow the steps below to begin filing your flood claim.

- Start a claim

- Prepare for your inspection

- Work with your adjuster

- Document your loss and receive payment

- Make Repairs– You must also take action to minimize the growth and spread of mold as much as possible after a flood. The Standard Flood Insurance Policy (SFIP) will not cover mold damage when a policyholder fails to take reasonable action within their control to prevent the growth and spread of mold. To learn more about safe and effective flood cleanup, visit EPA.gov to download the Homeowner’s and Renter’s Guide to Mold Cleanup After Disasters.

- Understanding Claim Payments-It can take four-to-eight weeks before a standard claim is finalized and paid. The claim payment check will be made out to you and, if applicable, your mortgage company/lender, which require additional sign offs.

- If FEMA denys your claim: If you receive a letter from your flood insurance company denying all or part of your claim, and you disagree with the denial, you have several options. Any policyholder insured through the NFIP has a right to appeal an insurer’s flood insurance claim denial to the agency. You must submit the appeal within 60 days after the date of the insurance company’s written denial letter. You may only appeal what the insurance company denied in the denial letter. For additional information, visit FloodSmart.gov/flood/appeal-your-claim-payment

Apply for disaster assistance.

When there is an official Presidential Disaster Declaration, NFIP flood insurance policyholders are encouraged to apply for FEMA disaster assistance in addition to their flood insurance claim.

For eligible individuals, FEMA disaster assistance may help with uncovered expenses like temporary housing assistance or other needs.

To learn more and apply, visit DisasterAssistance.gov or call 800-621-3362. Or use FEMA’s online resources.

Additional flood claim resources

How to File a Flood Insurance Claim This infographic may be helpful as you go through the steps to file your claim.

What if my insurance company does not respond?

Insurers are required to respond to a claim within seven days, according to state law. They then must make a determination on that claim within 60 days. If your insurer is not responsive, you can file a complaint with the state’s Division of Consumer Services. You can also contact the state’s insurance consumer advocate at 850-413-5923 or YourFLVoice@MyFloridaCFO.com.

Claims Handbook Tips to help you as you go through the process of starting and filing your flood insurance claim.