The 50/50 rule, it is a plan to lower flood insurance costs.

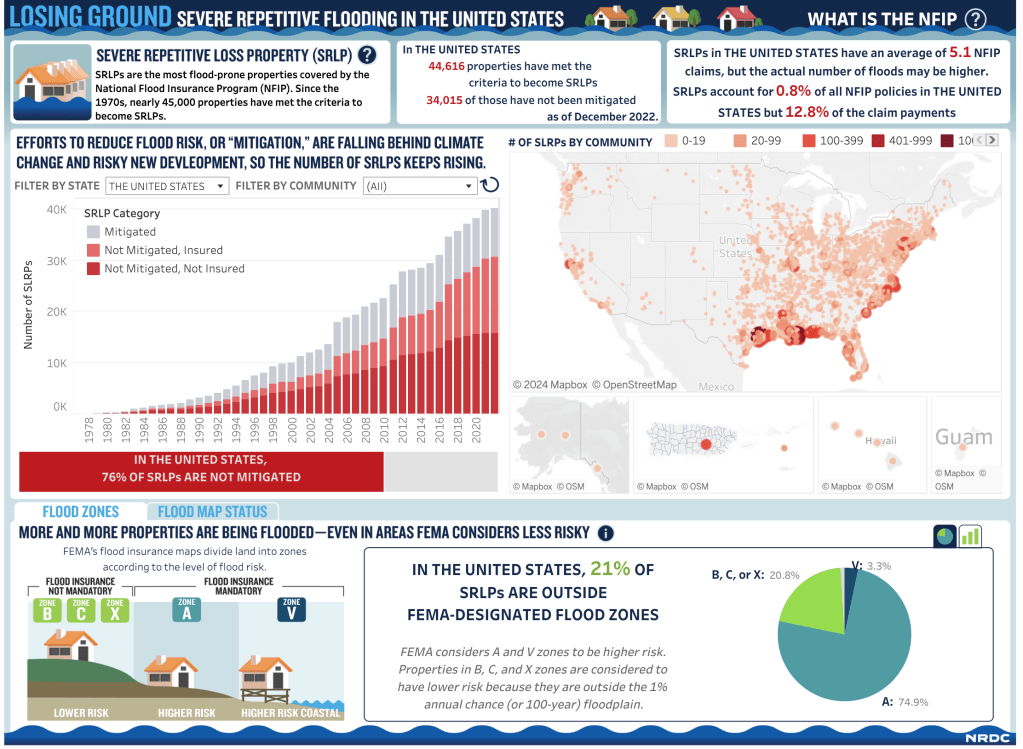

In the last decade, the same properties in the U.S. that flood over and over claim an outsized amount of flood claims because they are built in places that flood. One percent of all flood insurance policyholders claim more than 13% of all claims. Three-fourths of those repetitive claim properties have NOT been mitigated. They will flood again and you will pay for it.

Even worse, the number of Americans living in these high-risk areas in 2016 climbed 14 percent compared to those living in the same neighborhoods in 2000. That’s actually faster than in areas outside of flood zones, where the population increased 13 percent. “The nation is spending billions every year to move people into flood-prone areas and keep people living in flood-prone areas,” says Rob Moore of the Natural Resources Defense Council. “We’ve gotten exactly what we paid for.”

The National Flood Insurance Program (NFIP) was created in 1968 to provide affordable insurance against flood risk and decrease overall risk across the country. Since then, nearly 45,000 properties have met the criteria to become what the program refers to as Severe Repetitive Loss Properties (SRLPs). These properties, the most flood-prone structures insured under the NFIP, have flooded about five times each, on average.

Every year, more and more Americans find their homes underwater and their lives upended by flooding. For many, this has become a yearly occurrence. As climate change continues to raise sea levels and drive increases in extreme weather, areas vulnerable to flooding are expanding rapidly. Meanwhile, people build in risky areas, often without considering how conditions may change over a building’s lifetime.

The 50% Rule incentivizes owners and insurers alike to make the improvements necessary to a property to prevent it from experiencing similar damage. As such, the 50% Rule should lower the costs of flood damage to property owners and insurers over time.

By the way, much of the worst repetitive flood damage is not coastal. It is next to rivers and creeks. Three-fourths of those properties are not properly mapped as risk zones. The climate-induced risks are changing faster than our maps.

The notion that we should not be paying year after year to fix properties that are in the line of flooding danger but do nothing to prevent the flooding is much easier to ingest when it involves other parts of the country where homes are perched on riverbanks or near creeks that rise with the spring snow melt. But the raw truth is that Floridians have been building waterfront properties knowing, somewhere in our hearts, that such construction comes with a risk that is rising with climate change.

The Natural Resources Defense Council has been loudly critical of the federal government’s slow updates to the national flood maps and makes these recommendations:

We need to comprehensively reform the NFIP. Currently, the program relies on outdated maps and rules that don’t account for climate change. Congress must update the NFIP to accurately reflect flood risk, provide more accessible data, enforce stronger codes and standards, and allow FEMA to make flood insurance more affordable for those who need it most. As the U.S. Government Accountability Office pointed out in a recent report, increasing mitigation alone won’t solve the problem if the NFIP continues to incentivize risky actions.

At the local level, we also need to stop building in harm’s way. Nearly one in five SRLPs were built after the publication of local flood maps—when we should have known better. And new development in risky areas is still increasing, with populations growing faster in floodplains than elsewhere. The best way to stop repeated flooding is to not let it start in the first place.